Keeping Up With Inflation – Straight Talk on Supply Chain Issues

Running a business is never easy, even during the best of times, but in the current economic environment, new challenges arise almost daily. Without trying to bemoan or belabor the obvious (because we’ve all got our own challenges), perhaps some explanation is warranted as to what has been causing pricing unpredictability on our awning products, at least from our own humble perspective here in Southern California.

In the current economic environment, prices on materials can go up faster than they can be published. And no business can afford to be behind inflation—otherwise, they’re soon out of business.

THE SHOCKS KEEP COMING

Currently, supplier companies are actually raising prices faster than we can respond to the increases. Yes, it sounds crazy. These days even before prices can be published, they get can preempted, because nobody wants to be behind inflation. That’s why, despite prices that seem high today when compared to a year ago, customers may be better off purchasing sooner than later due to volatile market unpredictability and the prospect of even higher prices to come. Unfortunately, for our valued repeat customers who remember how competitive prices were just a couple years ago, the sticker shock is felt more acutely.

FEELING THE RIPPLE EFFECT

A product like awnings and the materials involved in their production is illustrative of the effects of inflation.

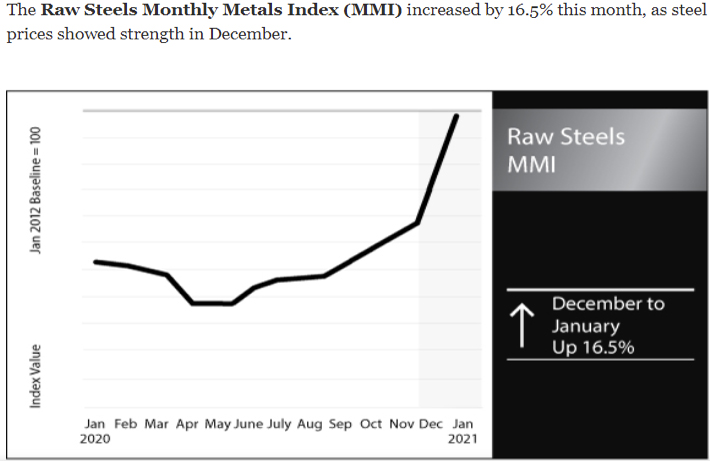

During recent months, stainless steel rose 17% in a single month. Aluminum, somewhat of a loss leader, might be up 60% over the course of a year on the London metals exchange.

Then there’s the cost added by extruders, whose own costs have tripled from 18 months ago. Manufacturing materials, of course, are only a portion of overall costs.

Materials must also be shipped, employees are needed to receive them, staff also require protective gear, chemicals and processes must be used, and the cost of energy to keep the lights on has all gone up.

Delivery times that were normally four to six weeks pre-pandemic are now seven to nine months. Clearly, a manufacturing business can’t go long without the materials needed to make its product.

Consequently, Accent Awnings now has to maintain a greater inventory on hand in order to meet demand in a timely manner.

Historically, Accent Awnings increased prices every two to three years. Now, we could very easily increase our prices every three months.

Since December 2020, some of our suppliers have had seven price increases! We’ve never experienced that historically. Consequently, we’ve had to raise wages significantly to keep up, and that’s just to get candidates to come in the door.

We’re still planning on giving staff raises at the end of the month, just so good people don’t go elsewhere. But even if the materials (aluminum, stainless steel, galvanized steel) due return to historical market norms, the cost of labor will not be going back down.

MADE IN USA?

If there was a truth serum, you might see advertising from certain people that said, “yeah, we’re cheaper because we’re lower quality.”

But mostly that’s the case. So, how low do you wanna go when it comes to price vs. quality?

Take awning motors. Their price difference between a Chinese motor and a European motor can be a couple hundred dollars. We happen to use European motors. But the competitor’s awning motor carries names like American Heritage or Spettmann Awnings USA, or Alaco USA. When in fact, they all come from Dooya Motors in China.

Spettmann Awnings USA Hardware is owned by a company in China—the company does all or almost all its manufacturing in Ningbo and Qingdao, China. But they say it’s “made in the USA” even though they’re merely shipping it from the City of Industry and assembling it to their dealer-order specifications.

IF IT LOOKS TOO CHEAP TO BE GOOD, LOOK OUT

Customers will usually think, “Well, that can’t be, because it’s illegal!” But the authorities are not interested in going after a small awning company running an ad in a home improvement magazine.

Misleading claims can be difficult to prove, but sometimes possible to thwart with some planning. During a period in which many companies were pulling a “bait and switch” with the solid colors of Sunbrella awing fabric, our company lobbied Sunbrella for a campaign. In response, they created a liSle sewn-in tab that said “Certified Sunbrella.” That liSle tab helped to combat inferior knock-offs that were half the price of most brands found in Southern

California then. By the way, the warranty from that cheaper fabric was amazing: “Not covered for the effects of age, wear and tear”!

How cheap are we talking about? The knock-off was $6 a yard vs Sunbrella at $12. Now it’s $7 a yard, while Sunbrella is $14. It became advantageous for awning companies to switch out a black Sunbrella fabric to a Saluda because a homeowner would never know the difference.

But Sunbrella says most of the fabrics that they receive for a warranty claim (because they need a sample) are not actually Sunbrella fabric. The customer thinks they bought Sunbrella, but it’s not.

DOOYA OR DONTYA?

The Chinese have an interesting market strategy: offer a generous warranty based on the fact their motors are so cheap to build and replace, not based on durability. Since the cost of replacing is next to nothing, Dooya has extended its warranty beyond European manufacturers’ standard five-year warranty.

Most awning companies selling in California sell a relabeled awning motor from Dooya Motors. There’s little downside (except to the customer) in claiming the product will last seven years even if it won’t because it only costs $60 to replace.

HOW PRICES CAN UNDERCUT AND WORKAROUND WARRANTIES

When such a cheap product goes bad in only five years, it doesn’t matter. Because in the meantime, you’re selling more than the next guy because his actual cost is $200 more. Once you add a markup on top of that, you’re talking a $400 difference. We’ve seen Dooya Motors selling for $100 with all the components, including a handheld remote and a cable and a manual override—the works. Then there’s a Somfy motor for about $505—with no extras listed to account for the difference.

The amount of work-arounds that some companies will go through to hide the country of origin is substantial. And it’s extremely misleading. A little extra due diligence on the part of the purchaser is often necessary.

Clearly, many of today’s market conditions are beyond our control at present. That’s why we’re doing everything we can to adapt as needed, especially by supporting American manufacturers and maintaining open communication with our customers and supplier partners. Thank you for your continued support.